does new hampshire charge sales tax on cars

Montana Alaska Delaware Oregon and New Hampshire. Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc.

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Call the Audit Division at 603 230-5030 for additional assistance.

. The states that charge zero sales tax on vehicle transactions are Alaska Delaware Montana New Hampshire and Oregon. Town Clerk TC - 200. Washington DC the nations capital does not charge sales tax on cars either.

No there is no general sales tax on goods purchased in New Hampshire. There are however several specific taxes levied on particular services or products. States With No Sales Tax on Cars.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. Unfortunately unless you register the car in a tax-free state you will still have to pay the sales tax when you register the vehicle in its state of residence. These five states do not charge sales tax on cars that are registered there.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. Tax Rate x MSRP 12 months x Number of Months Vehicle will be Registered 1000. Administrative costs of preparing an auto.

Does New Hampshire chage a sales tax when buying a used car. The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

The Granite States low tax burden is a result of. A 9 tax is also assessed on motor vehicle rentals. 18 15 12 9 6 and 3.

For more information on motor vehicle fees please contact the NH Department of Safety. We use cookies to give you the best possible experience on our website. Are there states with little to no sales tax on new cars.

2022 New Hampshire state sales tax. Companies or individuals who wish to make a. Five states charge no sales tax at all when you buy a car.

There are however several specific taxes levied on particular services or products. States like Montana New. No capital gains tax.

So if you live in Massachusetts a state that has sales tax but buy a car in New Hampshire a state with no sales tax you will still have to pay tax to your home state of Massachusetts when you go to get your license plates. New Hampshire is one of the few states with no statewide sales tax. Exact tax amount may vary for different items.

This means that you save the sales taxes. In Alabama the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. These excises include a 9 tax on restaurants and prepared food consumed on-premises a 9 tax on room and car rentals a tax of 000055.

The rate drops annual in 3 increments. New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. - Answered by a verified Tax Professional.

Only five states do not have statewide sales taxes. Purchase location does not determine sales tax for a vehicle state of registration does. So if you live in one of them you could be in for an excellent deal.

No inheritance or estate taxes. You pay it every year and it declines to around 200 but thats it. But it appears you have two sets of taxes that do get charged one a road tax of sorts that is 50 from my understanding and then a local excise tax based on the list price of the vehicle - heres a quote.

New Hampshire Delaware Montana Oregon and Alaska. Some other states offer the opportunity to buy a vehicle without paying sales tax. 15 12 9 6.

The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes. An exception to this would be if you live in Alaska Delaware Montana New Hampshire or Oregon five states that dont charge sales taxes on cars. New Hampshire is one of the five states in the USA that have no state sales tax.

New Hampshire is one of the few states with no statewide sales tax. What confuses people is the property tax on cars based upon their book value. By continuing to use this site you consent to the use of cookies on your device as described in our cookie policy unless you have disabled them.

However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states. New Hampshire does not charge sales tax on vehicles.

For example you could trade-in your old car and receive a 5000 credit against the price of a 10000 new vehicle making your out-of-pocket cost only 5000. Property taxes that vary by town. Print a copy of that webpage and present it to any entity that requires confirmation that New Hampshire does not issue Certificates for Resale or Tax Exemptions.

New Hampshire does collect. Motor vehicle fees other than the Motor Vehicle Rental Tax are administered by the NH Department of Safety. If you purchase a vehicle in New Hampshire but register it in another state you must pay sales tax for the state of registration.

Other fess authorized under State Statute and approval by the Board of Mayor and Aldermen BMA. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 10. There is no sales tax on anything in NH.

My neighbours who collect very expensive cars 1M do not. The annual tax rate for the current model year is 181000 of the list price. New Hampshire is one of just five states that do not have a sales tax so youre in luck when you need to purchase a vehicle.

Auto registration tax rates per 1000 of MSRP. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle purchase. Does New Hampshire have a sales tax.

A 9 rooms and meals tax also on rental cars A 5 tax on dividends and interest with a 24004800 exemption plus additional exemptions.

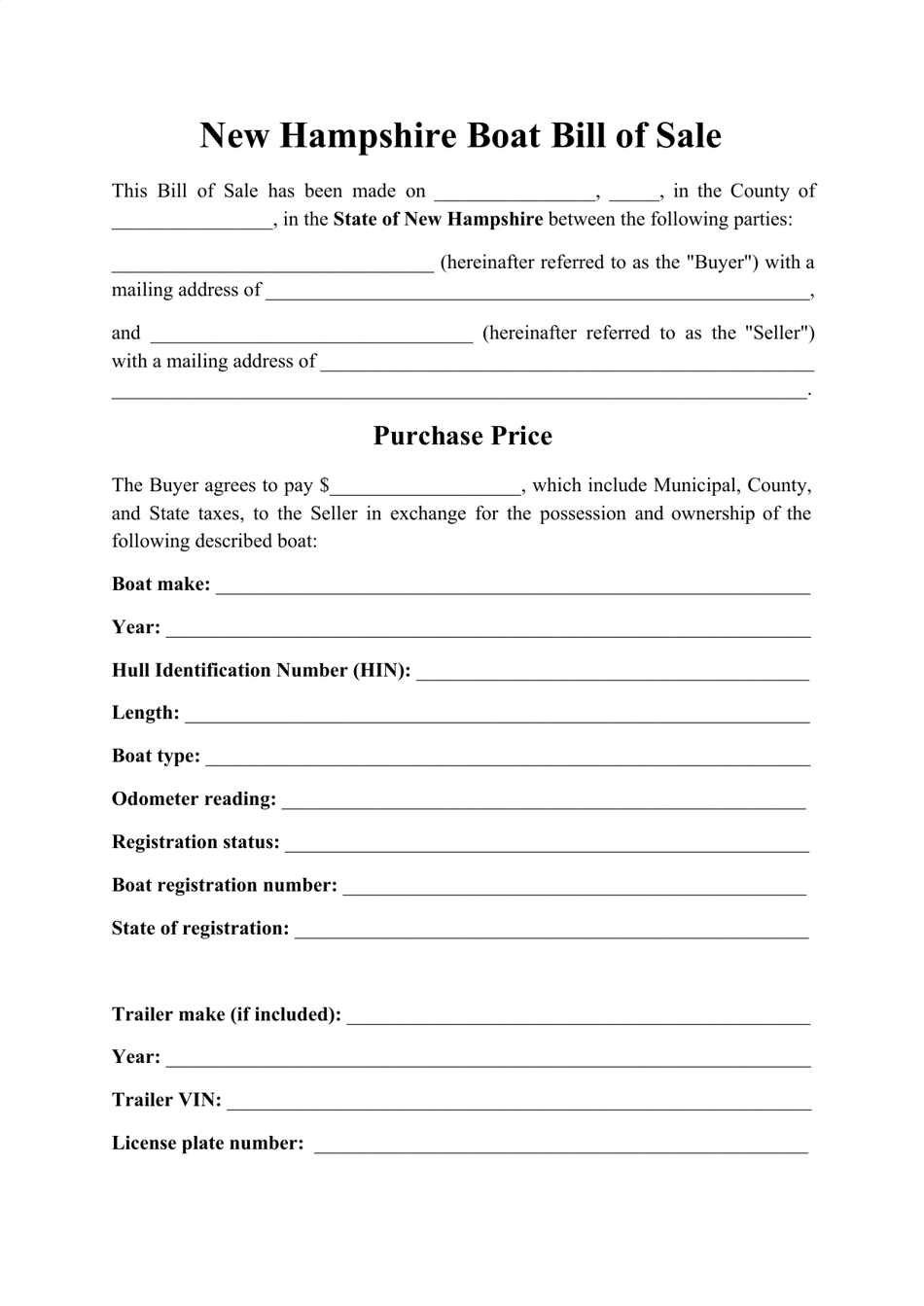

New Hampshire Boat Bill Of Sale Form Download Printable Pdf Templateroller

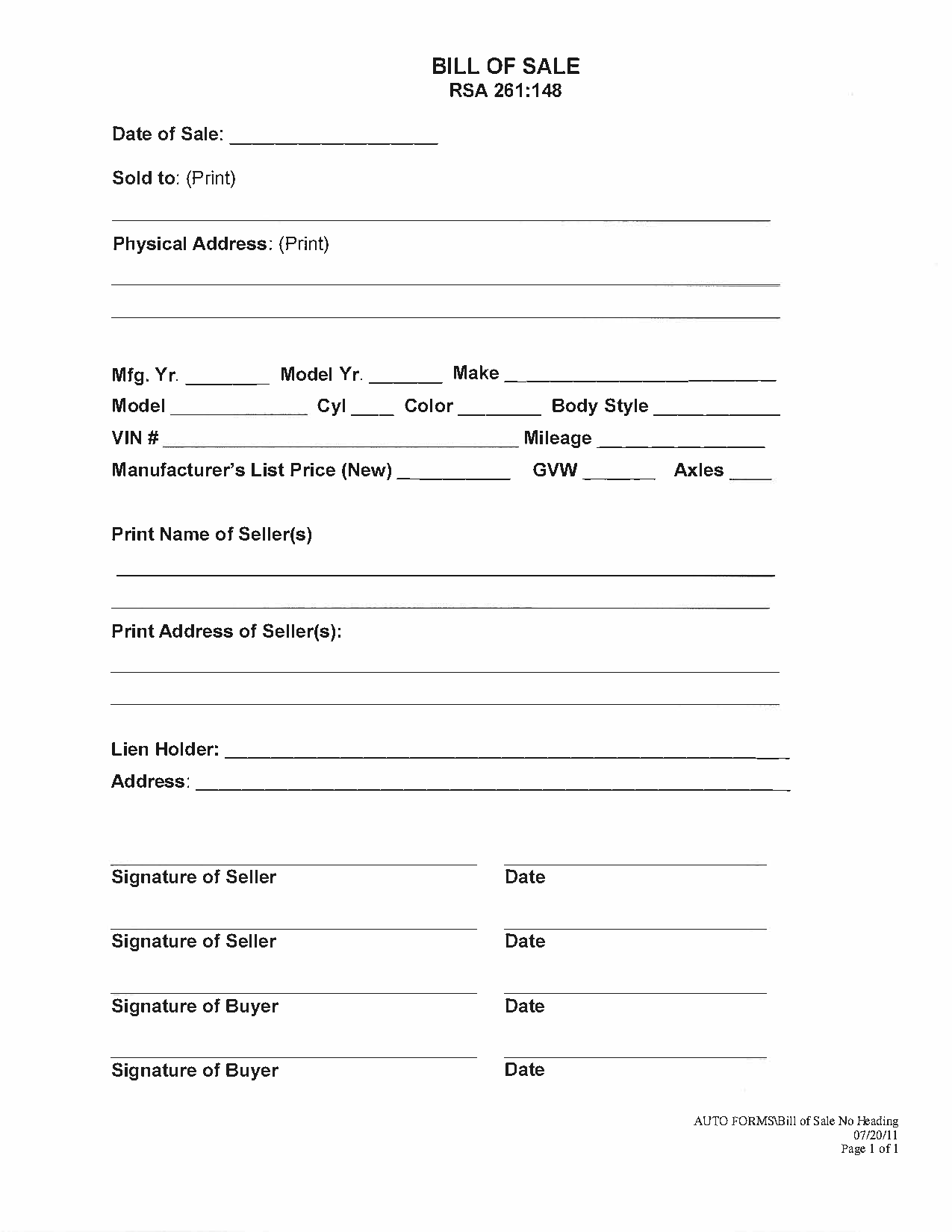

Free New Hampshire Motor Vehicle Bill Of Sale Form Pdf Word

New Hampshire Golf Cart And Lsv Laws Golfcarts Org

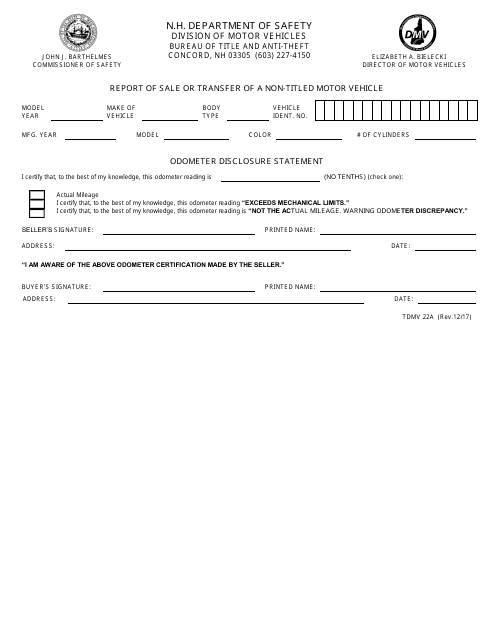

Form Tdmv22a Download Fillable Pdf Or Fill Online Report Of Sale Or Transfer Of A Non Titled Motor Vehicle New Hampshire Templateroller

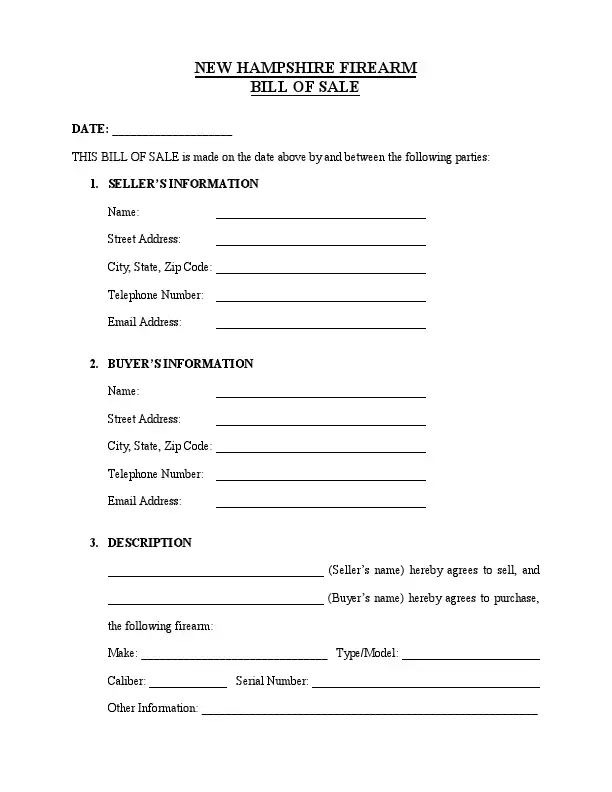

New Hampshire Bills Of Sale Facts To Know Templates To Use

Free New Hampshire Bill Of Sale Forms Formspal

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

New Hampshire Bills Of Sale Facts To Know Templates To Use

Property Tax Rates 2009 Vs 2020 R Newhampshire

How To Start A Business And Form Your Llc In New Hampshire Mycompanyworks

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Nj Car Sales Tax Everything You Need To Know

How To Sell A Car In New Hampshire The Dmv Rules For Sellers

Free New Hampshire Bill Of Sale Forms Pdf

New Hampshire Car Insurance The General Insurance

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Sales Tax Handbook 2022

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price