corporate tax increase canada

The corporate tax rate on large financial institutions mostly banks and life insurers would climb three percentage points to 18 from 15 and apply to earnings above 1. The following rates are applied.

Updated Corporate Income Tax Rates In The Oecd Mercatus Center

Under the previous governments plans the rate of Corporation Tax was to increase from 19 to 25 from April 2023 for firms.

. Tax rates are continuously changing. Corporate taxes in Canada are regulated at the federal level by the Canada Revenue Agency CRA. Budget 2022 also proposes to permanently increase the corporate income tax rate by 15 percentage points on the taxable income of banking and life insurance groups as.

Canadian personal tax tables. All provinces and territories impose a premium tax ranging from 2 to 5 on insurance companies both life and non-life. Corporate tax in Canada.

Corporate tax cuts benefit all Canadians. Excluding jurisdictions with corporate tax rates of 0 the countries with the. The tax provisions of the FY23 budget are intended to.

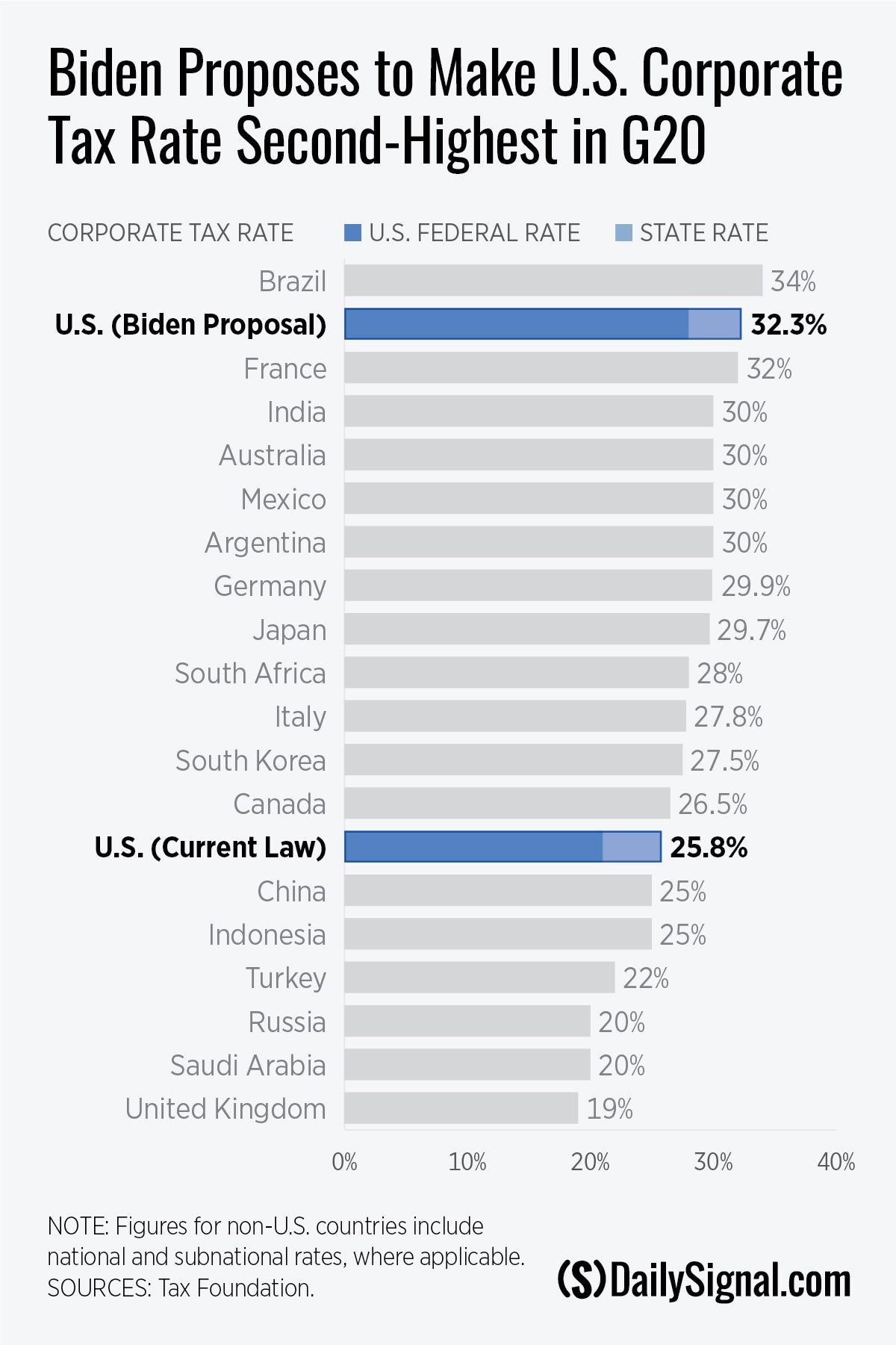

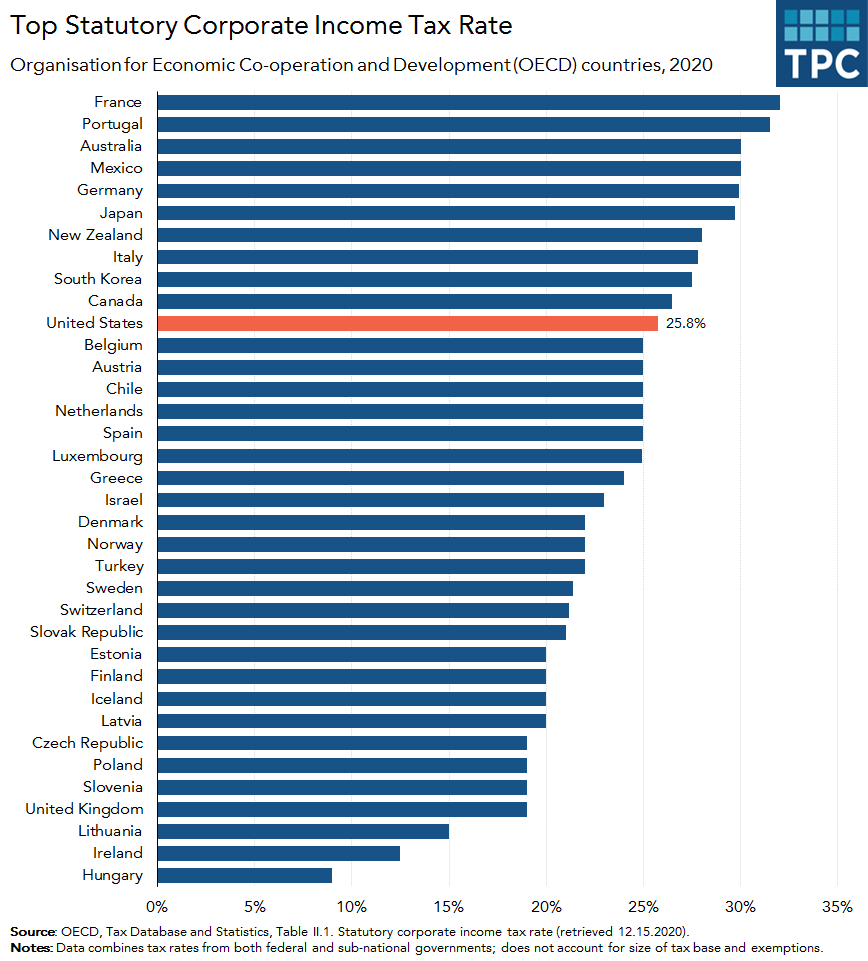

Get the latest rates from KPMGs personal tax. The most important proposal for companies is the possible increase in the corporate tax rate from 21 to 28. Comoros has the highest corporate tax rate globally of 50.

KPMG in Canadas corporate tax professionals provide a variety of services including. Although the tax base is substantially the same there. Tax planning and advice.

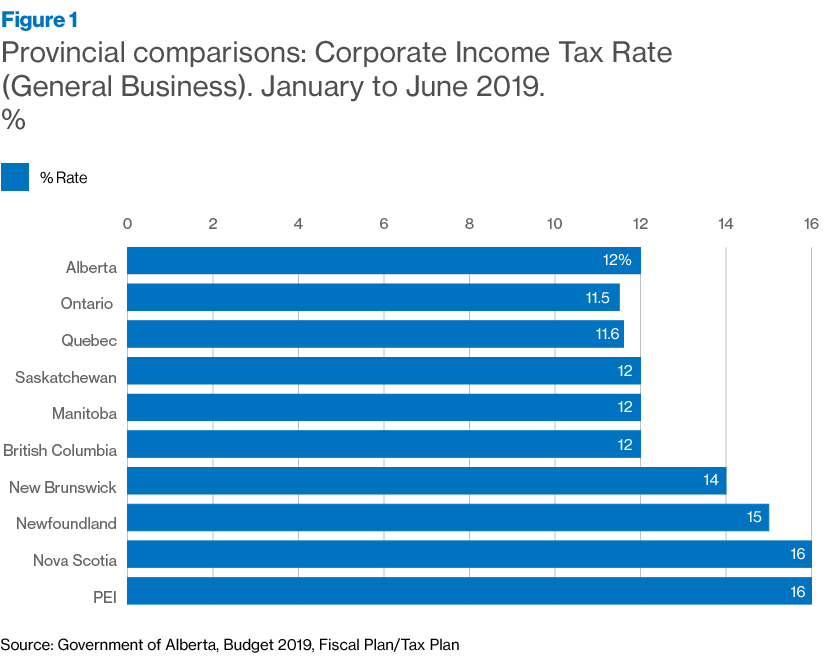

New report compiles 2021 corporate tax rates around the world and compares corporate tax rates by country. As a result Albertas combined federal-provincial general corporate tax dropped from 25 percent to 23 percent the lowest general corporate tax rate in Canada and lower. Puerto Rico follows at 375 and Suriname at 36.

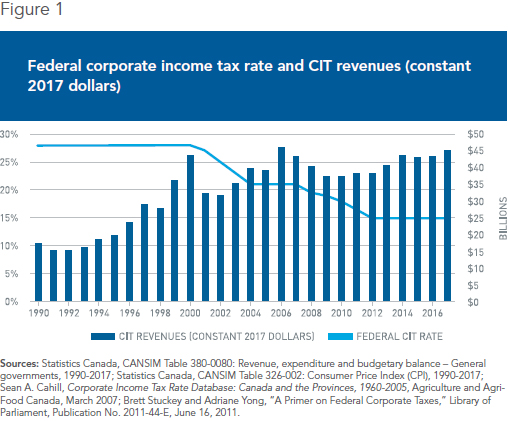

Reduce their administrative tax burden through tax management and. In Canada corporate income taxes are levied separately by both the federal government and the provincial and territorial governments. Canada imposes very low corporate tax rates on small businesses.

Corporation income tax overview Corporation tax rates Provincial and territorial corporation tax Business tax credits Record keeping Dividends Corporate tax payments. See the latest 2021 corporate tax trends. CCPCs with taxable capital below 10 million a tax rate of 90 is applied on the first 500000 of taxable income which is the small.

Insights and resources. As of January 1 2019 the net tax rate after the general tax. In addition Ontario and Quebec impose a capital.

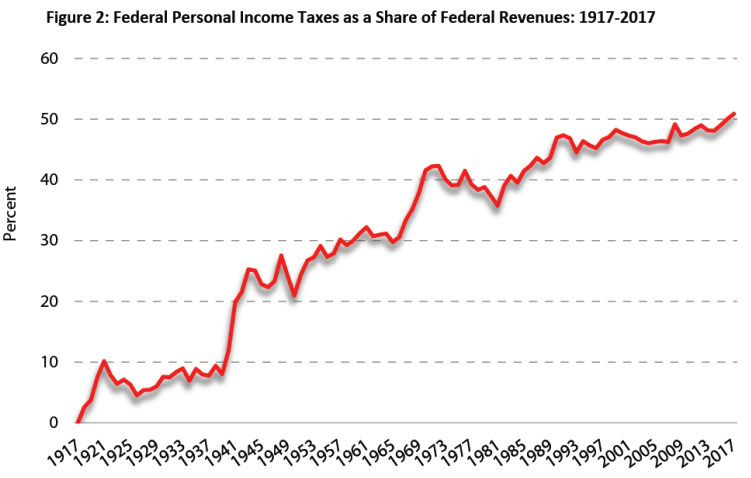

On average across the provinces the combined corporate tax rate for small Canadian-controlled private. Corporation Tax rise cancellation factsheet. Globe and Mail columnist Eric Reguly recently bemoaned that the share of government revenue coming from corporate income.

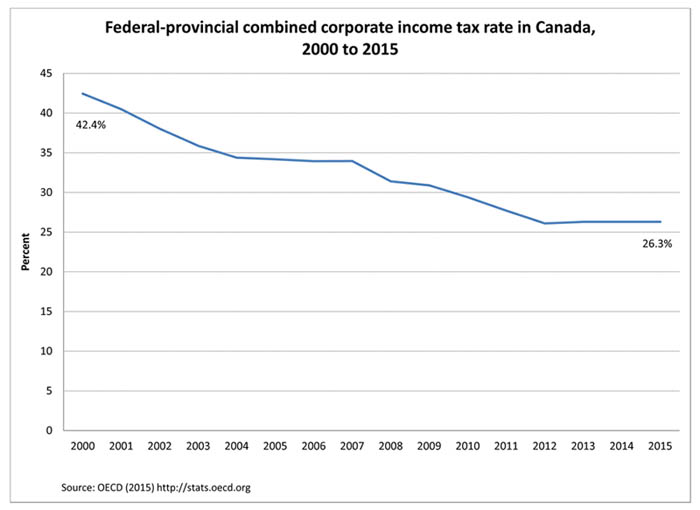

Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to. Corporate Tax Rate in Canada averaged 3757 percent from 1981 until 2020 reaching an all time high of 5090 percent in. The Corporate Tax Rate in Canada stands at 2650 percent.

Canada S Corporations Have Already Earned Enough To Pay Their Income Taxes For The Year Huffpost Business

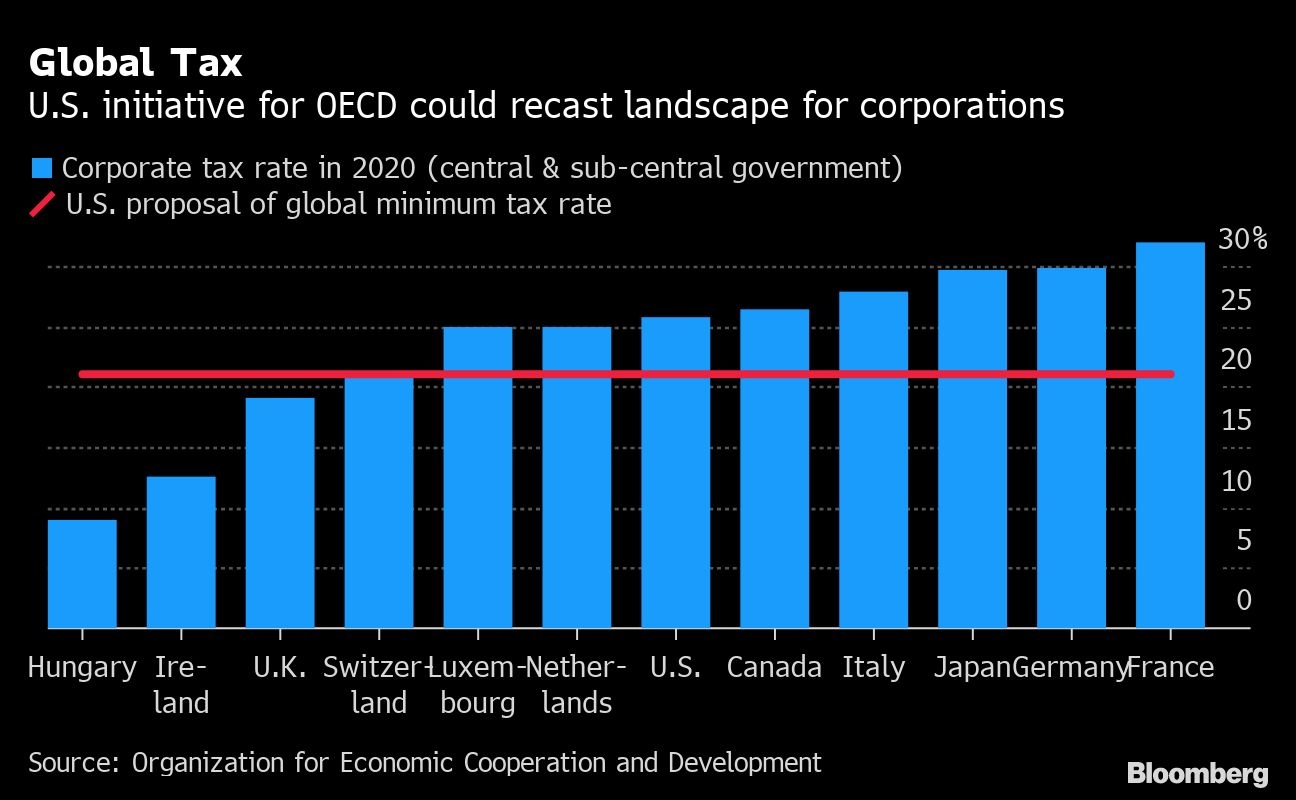

Global Corporate Taxes Face Revolution After U S Shift Bnn Bloomberg

Raising Corporate Taxes Is Bad Economic Policy Fraser Institute

Biden S Business Tax Hikes Would Be A Self Inflicted Mistake For America The Heritage Foundation

Kalfa Law Business Tax Rates In Canada Explained 2020

Complete Guide To Canadian Marginal Tax Rates In 2020 Kalfa Law

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Have Taxes Changed All That Much Over The Past Half Century Canadian Centre For Policy Alternatives

B C Top Income Tax Rate Nears 50 Investment Taxes Highest In Canada Nanaimo News Bulletin

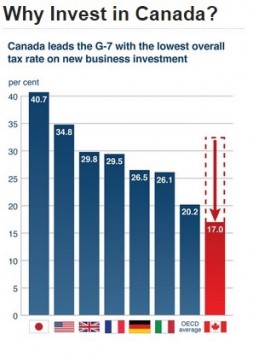

Canada Highlights Low Corporate Tax Rates To Promote Foreign Investment Rci English

Investor Brief Why Alberta Business Taxes Are Coming Down Not Going Up Energy News For The Canadian Oil Gas Industry Energynow Ca

Canada S Failed Corporate Tax Cutting Binge Canadian Centre For Policy Alternatives

Gabon Corporate Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical Chart

Oecd Corporate Tax Rate Ff 01 04 2021 Tax Policy Center

Canada S Corporate Tax Cut Success A Lesson For Americans Iedm Mei

Major Changes To Canada S Federal Personal Income Tax 1917 2017 Fraser Institute

Why The Ndp S Exact Plan For The Corporate Tax Rate Matters Macleans Ca

Kalfa Law Business Tax Rates In Canada Explained 2020

What Will A 25 Corporation Tax Rate Mean For The Uk Company Debt